IOS

Android

MTB securities

MTB Capital

Mutual Trust Bank PLC (MTB) recently announced its unaudited financial results for the third quarter of 2024, showcasing remarkable resilience and growth. Amid an industry-wide struggle with customer confidence, MTB has demonstrated strong financial performance, driven by record breaking growth in customer deposits and solid bottom-line growths.

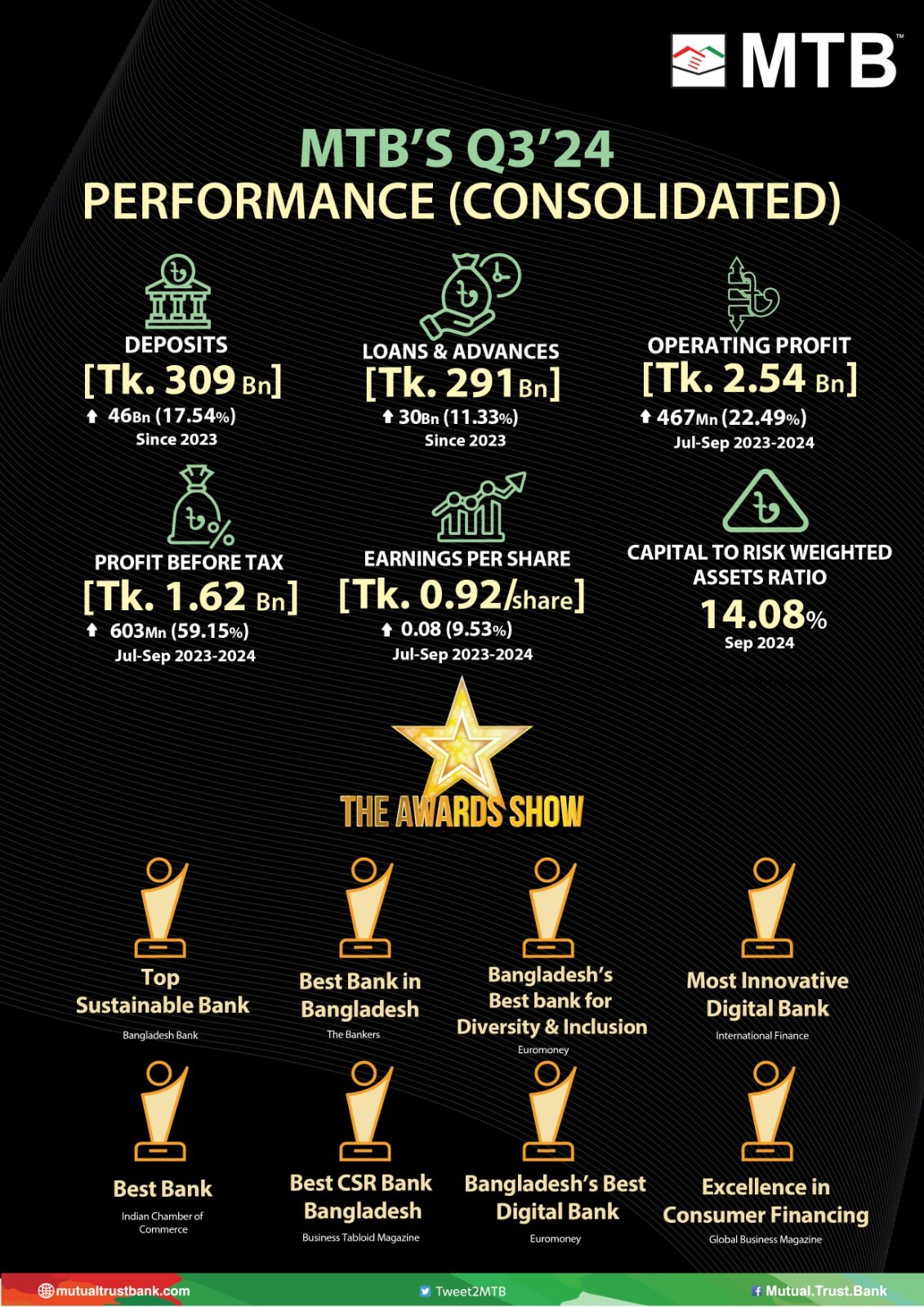

MTB’s strong financial performance in Q3 2024 reflects an impressive Tk. 46 billion growth, or a 17.54% increase in deposits since December of last year, totaling Tk. 309 billion. This outstanding growth is a testament to customer trust in MTB during this challenging time. Loans and advances registered an 11.33% increase, or Tk. 30 billion growth, reaching Tk. 291 billion during the same period. Operating profit rose by 22.49% to Tk. 2.54 billion, while profit before tax surged by 59.15% to Tk. 1.62 billion from July to September 2024. In the first nine months of 2024, the bank earned operating profit of Tk. 7.82 billion, a 33.38% YoY increase, while profit before tax stood at Tk. 3.53 billion, a rise of 9.35% over the corresponding period last year. Combined, these growth metrics steered earnings per share up by 6.7%, reaching Tk. 2.07 per share in the first nine months of 2024. Additionally, the bank’s capital to risk-weighted assets ratio (CRAR) stands at a robust 14.08%, further underpinning its stability and growth potential.

Beyond its exceptional financial growth, MTB’s achievements across its business operations have been widely recognized with over 20 national and international awards each year since 2022. Recent honors include a Top Sustainable Bank rating by Bangladesh Bank, Best Bank by the Indian Chamber of Commerce, Best Bank in Bangladesh by The Banker, Bangladesh’s Best Digital Bank by Euromoney, Bangladesh’s Best Bank for Diversity & Inclusion by Euromoney, Best CSR Bank Bangladesh by Business Tabloid Magazine, Most Innovative Digital Bank by International Finance, and Excellence in Consumer Financing by Global Business Magazine.

Syed Mahbubur Rahman, Managing Director & CEO, stated, “We have delivered a strong performance in the third quarter, with profit before tax up 59.15% YoY, driven by record growth in customer deposits, efficient balance sheet management, and cost rationalization.”

As MTB celebrates its 25th anniversary, it remains committed to delivering a strong financial performance for the remainder of the year, reflecting a forward-looking strategy that prioritizes customer trust and financial excellence.